Robo-advisors have disrupted the investing landscape, making it easier for especially beginners to dive in their financial journey. These automated platforms use algorithms and intelligent technology to handle your investments based on your risk tolerance.

- Picking the right robo-advisor is a crucial first step. Consider factors such as costs, initial investment requirements, and the range of asset classes offered.

- Once you've chosen a platform, opening an account is typically a breeze. You'll need to provide some basic data and answer questions about your financial goals.

- Occasionally review your portfolio performance and fine-tune your asset allocation as needed. Robo-advisors often provide recommendations to help you stay on track

With a little research and effort, you can leverage the power of robo-advisors to grow your savings over time.

Automated Financial Planners: Your Automated Path to Financial Success

In today's fast-paced world, managing your finances can feel overwhelming. Fortunately, here automated investment platforms are here to simplify the process and help you achieve your financial goals. These innovative services leverage sophisticated algorithms to create a personalized asset allocation tailored to your financial situation.

With a robo-advisor, you can easily invest your investments without the need for a traditional financial advisor. Simply provide some basic information about yourself and your financial aspirations, and the platform will do the rest. Digital wealth managers regularly adjust your investments to ensure you stay on track towards your financial goals.

- Advantages:

- Budget-friendly

- Easy to use

- Efficient

Whether you're a new to investing or a seasoned portfolio manager, robo-advisors offer a efficient way to manage your finances and pave the path towards long-term financial success.

Exploring Robo-Advisors: How They Work and Why You Should Consider Them

Have you ever dreamed of seamlessly managing your finances without the hassle of a traditional wealth manager? Enter robo-advisors, the digital investment platform that's revolutionizing personal finance. These smart programs use algorithms to create and manage a diversified portfolio tailored to your individual investment goals. By analyzing your investment preferences, robo-advisors efficiently invest your funds across a range of assets, mitigating risk while striving for optimal returns.

Robo-advisors offer a variety of perks that make them an attractive option for people of all experience. Firstly, they are budget-friendly, often charging significantly lower fees than human brokers. Secondly, they provide constant accessibility to your portfolio, allowing you to review your progress anytime, anywhere. Lastly, robo-advisors simplify the investment process, making it easy even for newcomers.

- Think about a robo-advisor if you are looking for a low-cost and efficient way to manage your investments.

Financial Success Simplified

Embarking on your financial adventure doesn't have to be complex. Robo-advisors offer a user-friendly approach to investing, making it accessible for everyone. Here's a step-by-step guide to get you started:

- Select a reputable robo-advisor that aligns with your financial goals

- Link your bank account and fund the desired amount

- Provide questions about your financial situation

- Analyze the recommended portfolio

- Observe your investments and optimize as needed

Robo-advisors automate your investments, providing a passive approach to wealth building. They periodically rebalance your portfolio based on market conditions and your investment strategy. By leveraging this platform, you can achieve your financial aspirations with minimal effort.

Tapping into Passive Earnings: The Power of Robo-Advisor Investing

In today's dynamic financial landscape, investors are constantly seeking innovative ways to build wealth and achieve their financial goals. One such method gaining immense traction is robo-advisor investing, a revolutionary approach that leverages technology to optimize the investment process. Robo-advisors utilize sophisticated algorithms and data analysis to construct personalized portfolios tailored to an individual's risk tolerance, time horizon, and financial objectives.

Moreover, robo-advisors offer a highly accessible platform for investors of all levels of experience. They typically have low fees compared to traditional financial advisors, making them an desirable option for those looking to maximize their returns while minimizing expenses.

- Strengths of robo-advisor investing include:

- Efficiency: Robo-advisors execute investment transactions and rebalancing automatically, allowing investors time and effort.

- {Diversification|Spread of Risk|: They construct portfolios with a spectrum of assets to reduce risk and potentially improve returns.

- Low Fees: Robo-advisors typically have lower fees compared to traditional financial advisors.

Overall, robo-advisor investing presents a attractive opportunity for individuals seeking to grow wealth passively. By utilizing the power of technology and data analysis, robo-advisors empower investors to achieve their financial goals with greater success.

Exploring Your Smart Choice for Investment Management: Choosing the Right Robo-Advisor

In today's dynamic financial landscape, savvy investors are exploring innovative solutions to optimize their portfolios. Robo-advisors have emerged as a compelling alternative, offering efficient investment management at an accessible price point. But, with a growing number of options available, selecting the right robo-advisor can feel overwhelming.

Consider your individual needs. Do you prioritize low fees, extensive portfolio customization, or niche investment strategies? Furthermore, assess your risk tolerance and investment goals. A reputable robo-advisor will offer personalized recommendations aligned with your aspirations.

- Research the platforms offered by various robo-advisors. Look for features such as goal-setting tools, tax-loss harvesting, and regular portfolio rebalancing.

- Consult customer testimonials and industry ratings to acquire insights into the experiences of other investors.

- Engage with customer support to evaluate their responsiveness and proficiency.

Ultimately, selecting a robo-advisor is a individualized decision based on your situation. By carefully considering your needs and conducting thorough research, you can discover the right partner to help you achieve your financial aspirations.

Alfonso Ribeiro Then & Now!

Alfonso Ribeiro Then & Now! Judge Reinhold Then & Now!

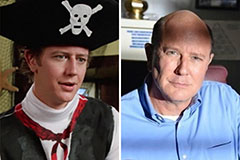

Judge Reinhold Then & Now! Charlie Korsmo Then & Now!

Charlie Korsmo Then & Now! Andrew McCarthy Then & Now!

Andrew McCarthy Then & Now! Katey Sagal Then & Now!

Katey Sagal Then & Now!